May 31, 2023

MileageWise is here to help you keep track of your vehicle expenses in the most efficient and accurate way. To help you better understand how our system works, we’ve prepared two mileage log samples that showcase both the standard mileage rate and the actual expense methods.

These two samples illustrate the different ways MileageWise can help you manage your vehicle expenses. Whether you choose the standard mileage rate or the actual expense method, we’re here to ensure you have accurate, easy-to-read logs for your tax reporting and reimbursement needs.

Get started with MileageWise today and experience the convenience and efficiency of our smart mileage tracking solution!

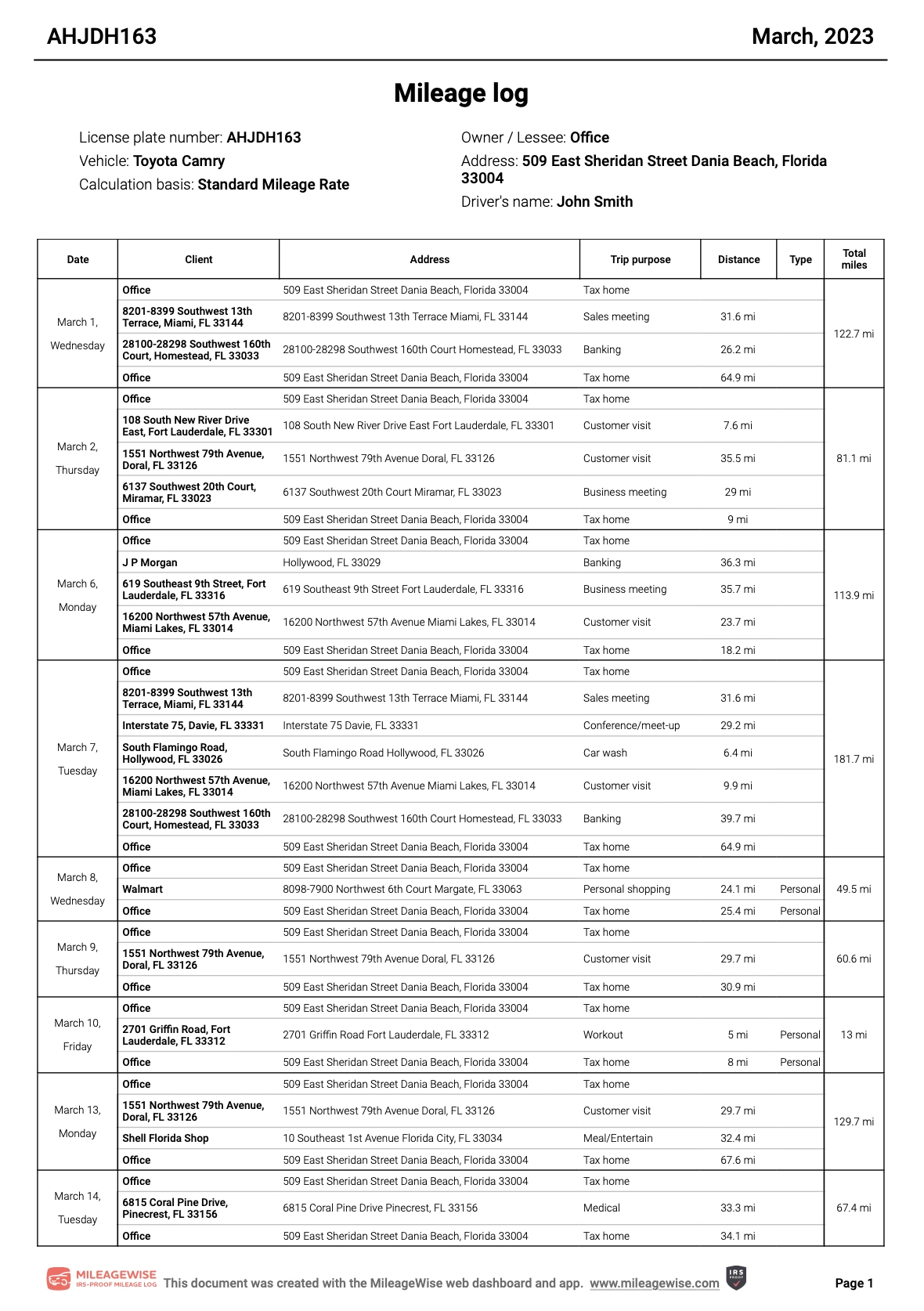

Mileage Log Sample – Standard Mileage Rate

The Standard Mileage Rate method offers a streamlined approach to calculating vehicle expenses, a feature that is ideal for businesses and individuals who favor simplicity and minimal paperwork.

This method revolves around a fixed rate set by the IRS for each mile driven for business purposes. As such, it eliminates the need to keep track of specific car-related costs. This rate is determined annually by the IRS and factors in the average costs of running a vehicle, including gasoline, maintenance, repairs, insurance, and depreciation. This rate is a reflection of the typical costs associated with owning and operating a vehicle over a year.

The key advantage of the standard mileage rate method is its simplicity. It requires fewer records since it only needs the number of miles driven for business purposes. You simply need to log the distance of your business journeys, and the system will multiply these miles by the current standard mileage rate to calculate your deductible vehicle expenses.

However, it’s crucial to understand that if you choose the standard mileage rate, you must opt for it in the first year the car is available for use in your business. In later years, you can choose to use either the standard mileage rate or actual expense method. But, if you lease your vehicle and choose the standard mileage rate, you must use the standard mileage rate method for the entire lease period.

Example Calculation

For example, the 2023 business standard mileage rate set by the IRS is 65.5 cents per mile, and if you drive 10,000 miles for business purposes in a year, you will be able to claim a deduction of $6,550 (10,000 miles x $.655 per mile) for vehicle expenses.

Medical Standard Mileage Rate

The Standard Mileage Rate method isn’t just for business use. The IRS also provides standard mileage rates for other types of driving. The IRS usually changes the mileage rate for medical or moving purposes year by year. This rate acknowledges the costs incurred when you use your personal vehicle for medical purposes. Whether it’s a trip to the doctor or to the pharmacy, this rate provides a simplified way to deduct these transportation expenses.

Charity Standard Mileage Rate

Additionally, if you’re driving for charitable purposes, such as volunteering your time and vehicle to a nonprofit organization, there’s a specific rate for this too. The IRS has set the standard mileage rate at 14 cents per mile for charitable purposes. This allows you to deduct your transportation costs when you’re on the road doing good.

Remember to always check the current standard mileage rate on the IRS website since the rate is subject to change every year. The standard mileage rate method is a testament to the fact that simplicity and efficiency can go hand in hand, proving its worth to those who value convenience and speed in their expense tracking.

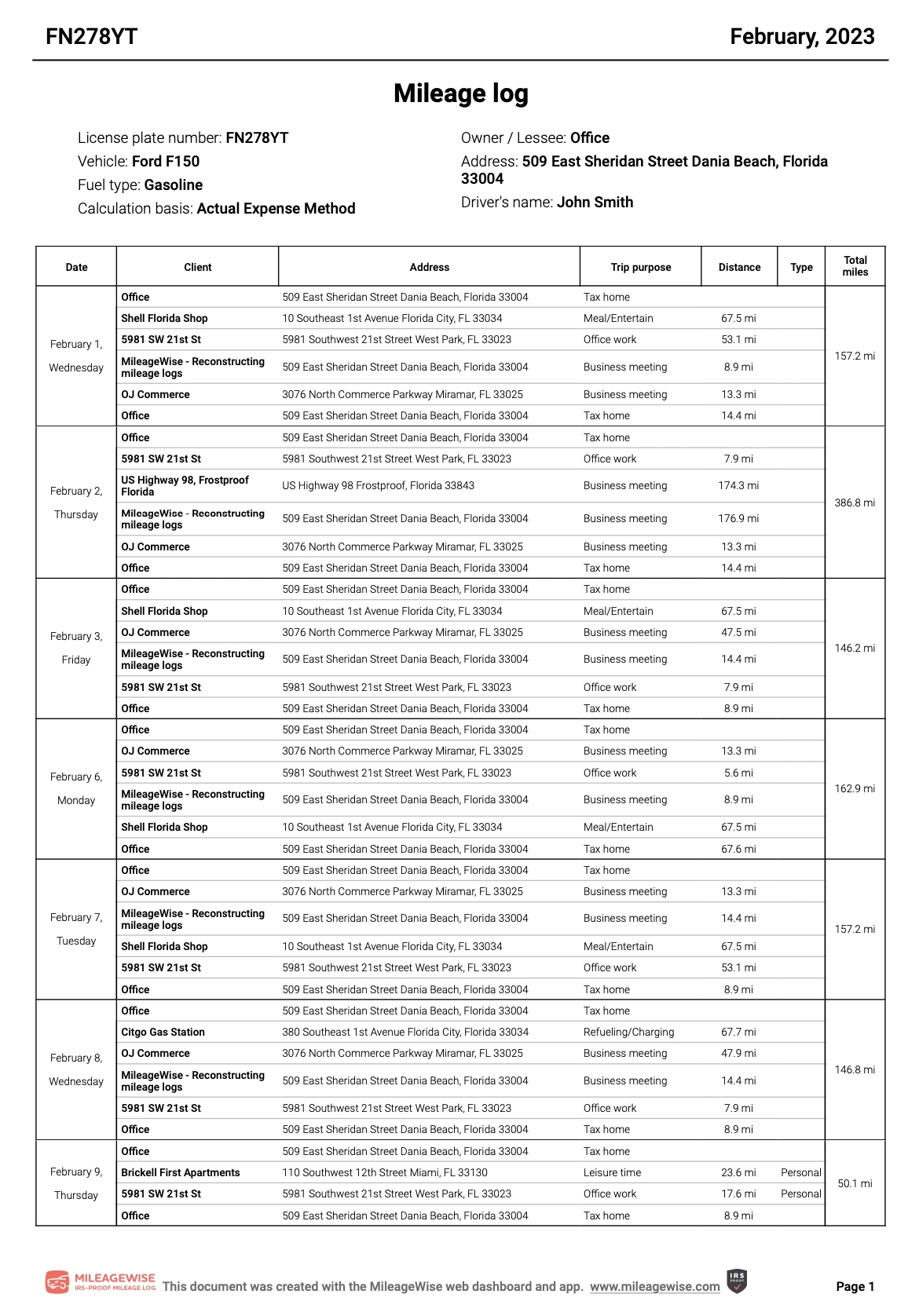

Mileage Log Sample – Actual Expense Method

The Actual Expense method offers a comprehensive and precise way to calculate vehicle expenses, which may be preferable for those who want to account for all of their vehicle-related costs or those who use more expensive vehicles where the costs surpass the standard mileage rate.

In contrast to the simplicity of the standard mileage rate, the actual expense method involves keeping track of all the costs associated with operating your vehicle. These costs include direct expenses such as gasoline, oil changes, tires, repairs, insurance, registration fees, and license.

Additionally, this method takes into account the depreciation of your vehicle, allowing you to factor in the loss in value over time due to wear and tear.

This method can potentially result in a higher tax deduction than the standard mileage rate, especially for those who have high-cost vehicles or vehicles with high running costs. The detailed record-keeping required can provide a more accurate reflection of your vehicle’s operating costs, rather than the average estimate provided by the standard mileage rate.

However, it’s important to note that the actual expense method requires careful record-keeping. With this method, you’ll need to keep all receipts for gas, repairs, maintenance, insurance, and other costs, and you’ll also need to track the percentage of your vehicle’s use that’s dedicated to business.

Fortunately, MileageWise has you covered with keeping track of your vehicle expenses, simplifying this detailed process. This is because only the business portion of your expenses is deductible, and with MileageWise’s efficient tracking and reporting capabilities, you can ensure accurate record-keeping and ease of calculation.

Example Calculation

For instance, if you spent $10,000 on eligible vehicle expenses throughout the year, and 75% of your total mileage was for business purposes, you would be able to deduct $7,500 (75% of $10,000) using the actual expense method.

While it requires more meticulous tracking, the actual expense method provides a detailed and accurate picture of your vehicle expenses. For those willing to keep thorough records, this method can offer greater benefits, ensuring that your deductions align closely with your actual vehicle costs.

The Standard Mileage Rate vs. The Actual Expense Method with MileageWise Mileage Log

In essence, both methods have their unique advantages, and the choice between the two will depend on your specific circumstances and requirements. The Standard Mileage Rate method is a great fit if you prefer convenience and ease, while the Actual Expense method is beneficial if you want a detailed record of your expenses and potentially higher deductions.

With MileageWise, you have the flexibility to choose the method that best suits your needs, offering a customizable, user-friendly solution for efficient vehicle mileage and expense tracking. Regardless of the method you select, whether it’s the Standard Mileage Rate or the Actual Expense method, you can rely on MileageWise to create a 100% IRS-Proof mileage log.

This ensures your mileage records are not only thorough and accurate but also compliant with IRS regulations, providing you with peace of mind and confidence in your record-keeping.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!