April 27, 2023

In today’s fast-paced world, efficiently managing your vehicle operating costs is key to maximizing your mileage tax deductions. MileageWise’s state-of-the-art mileage software, which includes an automatic mileage tracker app and a supporting web dashboard platform, introduces a new feature designed to revolutionize how you track and manage your automotive cost breakdown.

What is the Vehicle Expenses feature good for?

The Vehicle Expenses tab enables you to input your car repair costs and other car-related business expenses, displaying them on your IRS-Proof mileage log to facilitate precise and streamlined deductions based on the vehicle ownership costs and business usage ratio.

Keep in mind, that the Vehicle Expenses feature is exclusively available for users who choose the actual expense method to calculate their total cost of car ownership and mileage tax deductions.

Effortless Expense Tracking with the Vehicle Expense Tracker Feature:

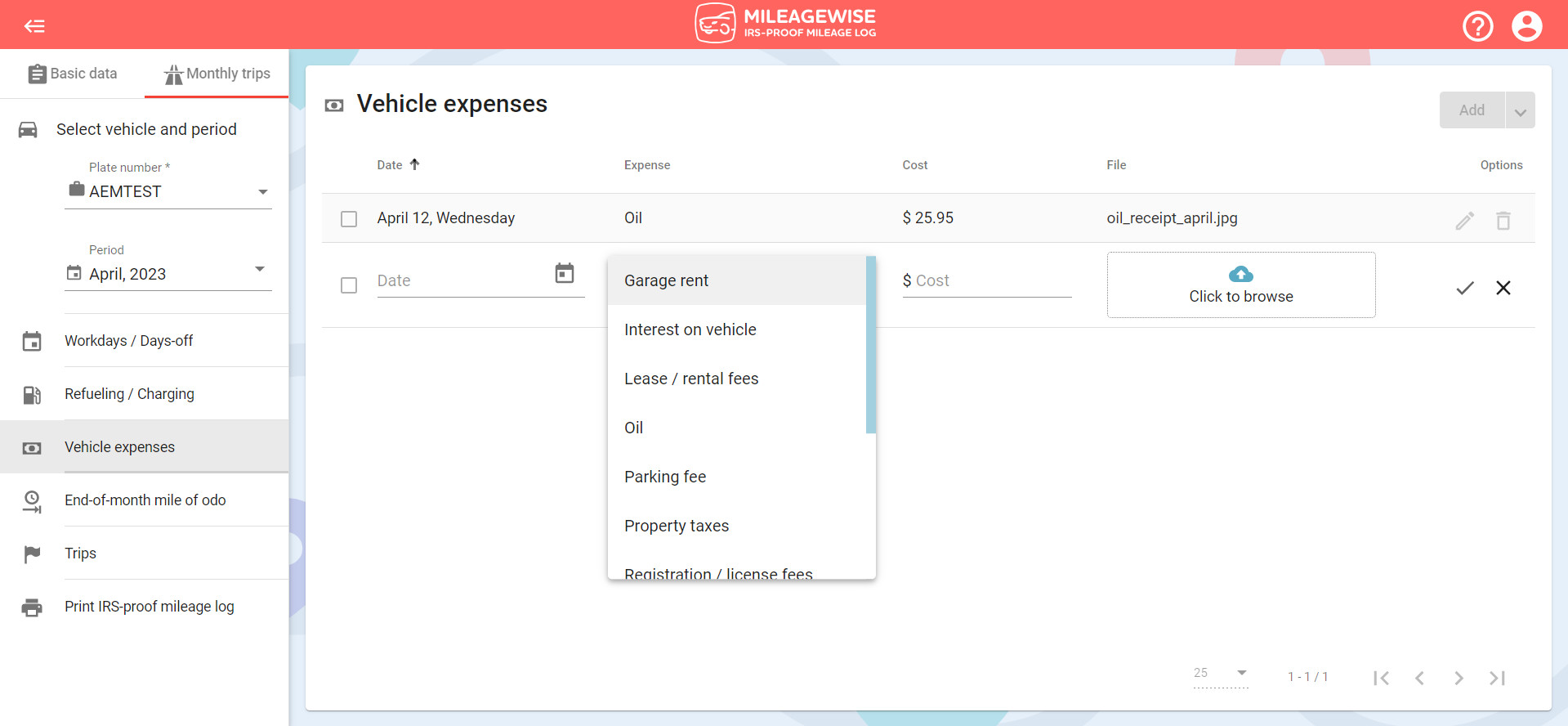

- Locate the Vehicle Expenses tab: To begin, access the Monthly trips menu in the MileageWise Web Dashboard and locate the Vehicle Expenses tab, where you’ll be able to input and manage your “car insurance premiums” and other expenses.

- Log your expenses: Choose the date of the expense, select the type of expense from the comprehensive list, input the dollar amount, and upload any supporting documentation (optional). To save your entry, click the checkmark.

- Review your expense report: All recorded expenses will appear as an expense report at the bottom of your finalized IRS-Proof mileage log, ensuring a seamless review and management process for your deductions.

TIP: Read our detailed help article about the topic.

The Vehicle Expense Tracker is also available in the MileageWise mobile app!

Locate it via the Add New Trip screen by tapping on the money icon.

A Wide Range of Expense Categories:

MileageWise’s Vehicle Expenses feature covers an extensive list of expense categories, which are:

- Garage rent

- Interest on vehicle

- Lease/rental fees

- Oil

- Parking fees

- Property taxes

- Registration/license fees

- Repairs & maintenance

- Tires

- Tolls

- Vehicle insurance

- Other expenses

These categories help you keep track of your fuel efficiency savings and vehicle depreciation expenses to optimize your tax deductions.

Enhanced Vehicle Expense Tracking with MileageWise:

MileageWise’s car cost tracking Vehicle Expenses feature not only simplifies the process of tracking your vehicle-related business expenses but also helps in optimizing your car expense management efforts.

With a user-friendly interface, the Vehicle Expenses feature allows you to easily categorize and monitor your expenses throughout the year.

By keeping a detailed record of expenses, such as vehicle insurance and car repair costs, you can make well-informed decisions to reduce your overall vehicle operating costs and improve your tax deductions.

Minimized Time, Maximized Tax Deductions

The Vehicle Expenses feature offered by MileageWise streamlines the process of monitoring and managing vehicle-related business expenses for users opting for the actual expense method. By providing a user-friendly and efficient way to input and categorize expenses, this feature allows you to maximize your mileage tax deductions and maintain a reliable, IRS-Proof mileage log.

Take control of your auto expense management with MileageWise and stay on top of your deductions while minimizing the time and effort required by MileageWise’s 3+1 automatic trip recording modes.