Sep 19, 2023

In the digital age, efficient mileage tracking has transformed from a tedious chore into a streamlined process. Whether you’re a freelancer, small business owner, or an avid traveler, every mile you drive can be a testament to productivity and potential tax deductions. Enter MileageWise, an app offering a suite of standout features. In this blog post, we’ll showcase the top 5 features of the MileageWise app that not only redefine mileage tracking but also simplify life for its users.

Let the journey begin!

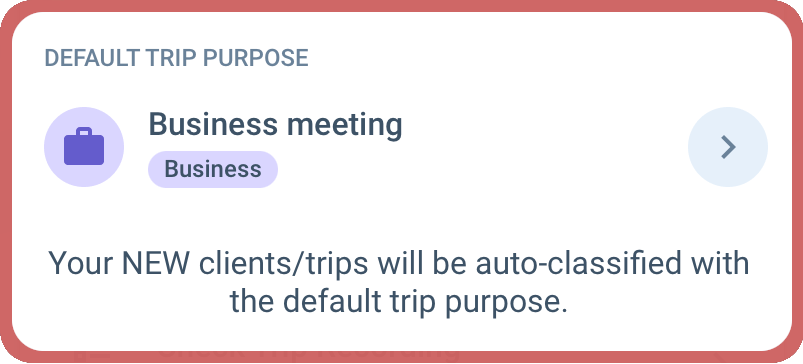

Trip auto-classification: Discover how MileageWise’s auto-classification feature effortlessly categorizes your trips for recurring visits to existing clients and offers a global default trip purpose setting to be applied to new clients, eliminating manual input and reducing errors. Of course, each trip can be manually edited, if necessary. Dive into our step-by-step guide to streamline your mileage tracking for optimal accuracy and insights.

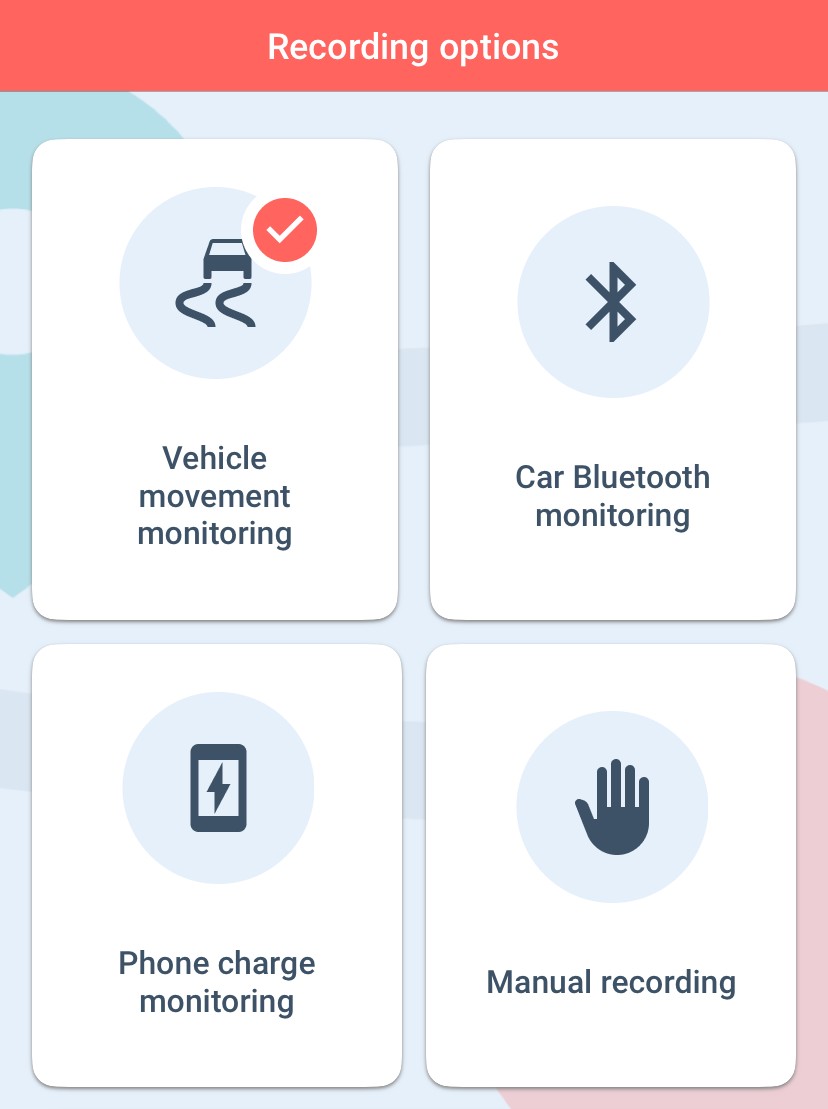

Auto-trip recording: Featuring three convenient auto-trip recording options (vehicle movement monitoring, Bluetooth monitoring, Plug’N’Go monitoring), you have the freedom to select the mode that suits your needs perfectly. Moreover, the app allows you to customize the recording schedule to your preference, such as limiting it to your working hours only. If there are scenarios where you’d prefer manual recording, you can choose that option too.

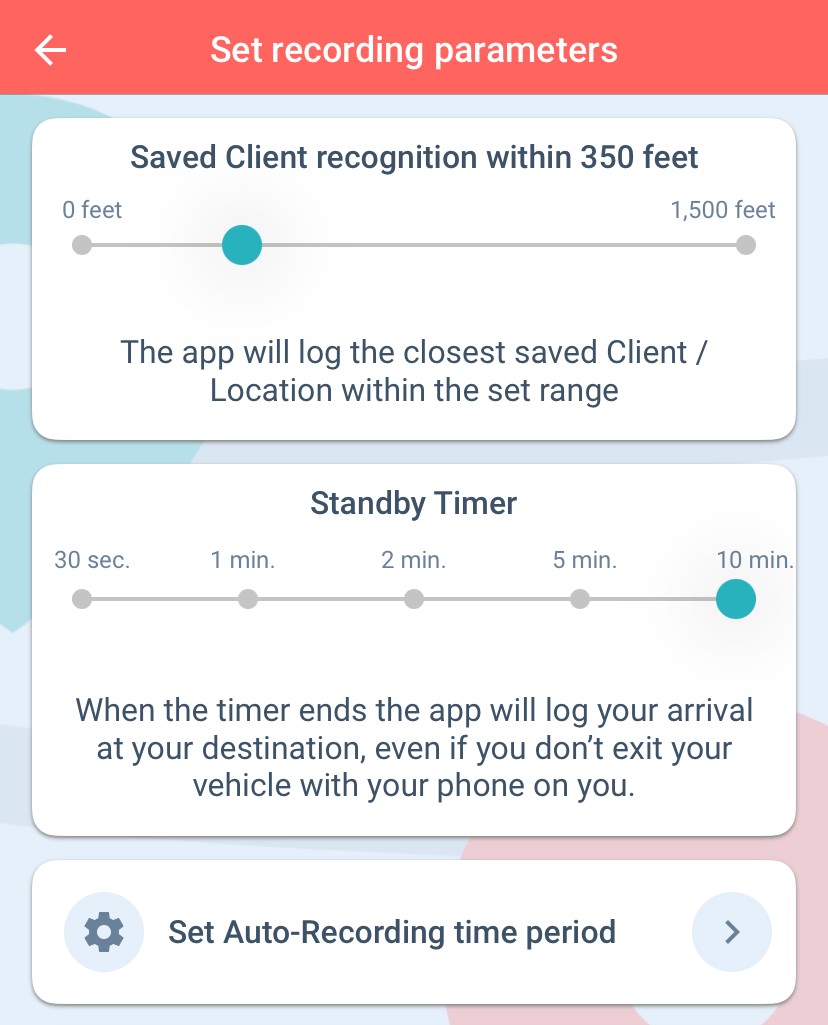

Set recording parameters: Features like the Saved client recognition, the Standby timer, or the Trip auto-classification let you fully customize the parameters of how your trips get recorded.

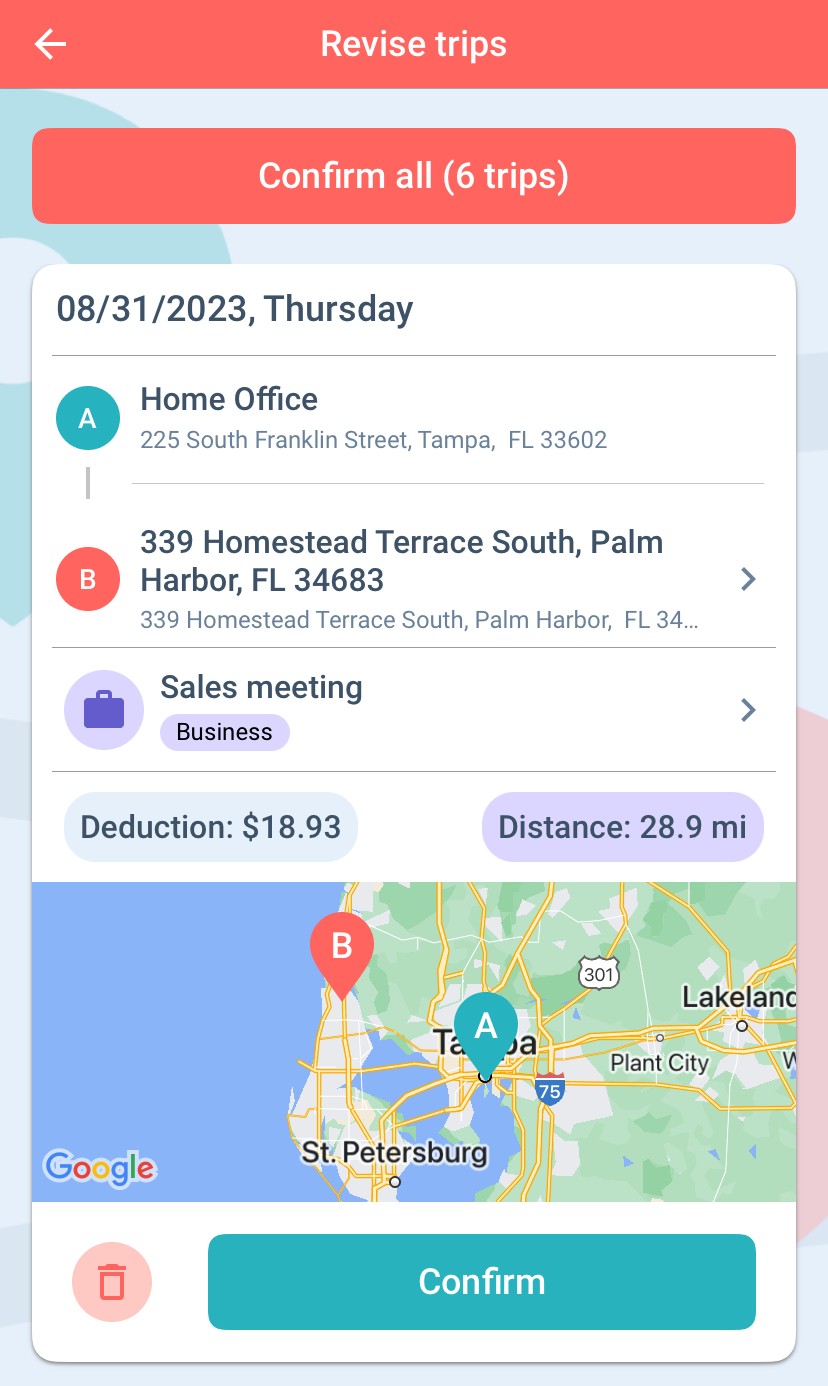

Revise Trips: this feature allows you to make changes to already recorded trips to fine-tune them. It lets you choose whether to retain the preset purpose for a new Client/Location, modify it, or potentially remove a trip, among other actions.

Vehicle Expense Tracker: The Vehicle Expense Tracker feature allows you to enter your car maintenance costs and other vehicle-related business outlays. These are then shown on your IRS-compliant mileage log, making it easier to calculate accurate deductions based on the costs of owning the vehicle and its business use percentage.

These top 5 features showcase MileageWise’s commitment to providing a hassle-free mileage logging experience. By integrating these functionalities, MileageWise ensures accuracy, efficiency, and user-friendliness, making it a top choice for mileage tracking. Whether you’re a freelancer on the go, a business owner, or just someone looking to keep track of their drives, MileageWise has got you covered.

Ready to give MileageWise a try?

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |