December 5, 2023

As a small business owner, you understand the importance of keeping meticulous records, especially when it comes to tracking mileage for business purposes. Whether it’s for maintaining a detailed mileage log for taxes or leveraging a mileage tracking app for business efficiency, the right tools can save you both time and money. Let’s dive into why a mileage tracker for business is an essential tool and how to choose the best one for your needs.

Why Use a Mileage Tracker for Business?

1. Accurate Mileage Log for Taxes:

Keeping an accurate mileage log for taxes is crucial for tax purposes. With tools like a mileage tracker for taxes or a mileage app for taxes, you can effortlessly record every business trip, ensuring you don’t miss out on any tax deductions.

2. Ease of Use with a Mileage Tracking App for Business:

Modern technology has made tracking mileage simpler than ever. A mileage tracking app for business automates the process, saving you the hassle of manual logs.

3. Optimize Expenses:

Using a mileage and expense tracker helps in budgeting and financial planning, offering insights into your business’s operational costs.

Choosing the Best Mileage Tracker App

1. Mileage App for Business:

Look for apps specifically designed for business use, with features like categorizing trips, generating IRS-Proof logs, and syncing with accounting software, like Freshbooks.

2. Best Business Mileage Tracker App:

Research and find the best business mileage tracker app that fits your business size and needs. Features like cloud storage, multi-vehicle tracking, and customizable reports can be beneficial.

3. Work Mileage Tracker for Company Vehicles:

If your business involves company vehicles, a company vehicle mileage tracker can help monitor usage, plan maintenance, and manage costs effectively.

Advanced Features to Look For

Multi-Vehicle Tracking: Essential for businesses with a fleet, enabling tracking of mileage for each vehicle.

Expense Tracking: Some apps combine mileage and vehicle expense tracking, offering a comprehensive view of your business expenses.

IRS-Compliance: the ultimate goal of tracking your business mileage is to be able to comply with the requirements set out by the IRS. If your mileage log doesn’t stand up to IRS scrutiny, you’re risking that your application will be audited.

Why MileageWise Is Your Best Bet As A Mileage Tracker For Business?

MileageWise is an innovative tool designed to assist small business owners in managing and tracking their business mileage efficiently. Here’s how MileageWise can be an invaluable asset for small businesses:

1. Comprehensive Mileage Tracking:

MileageWise offers both ongoing and retrospective tracking features, making it easier for business owners to keep a precise log of all business-related trips. This is particularly useful for maintaining a mileage log for taxes, ensuring that all deductions are accurately accounted for.

2. IRS-Proof Logs:

One of the standout features of MileageWise is its compliance with IRS regulations. This is crucial for small business owners as it ensures that their mileage logs meet all the necessary tax requirements, minimizing the risk of audits and penalties.

3. User-Friendly Interface:

The app is designed with user experience in mind, offering a simple and intuitive interface. This makes it easy for business owners who may not be tech-savvy to navigate and use the app effectively for mileage tracking.

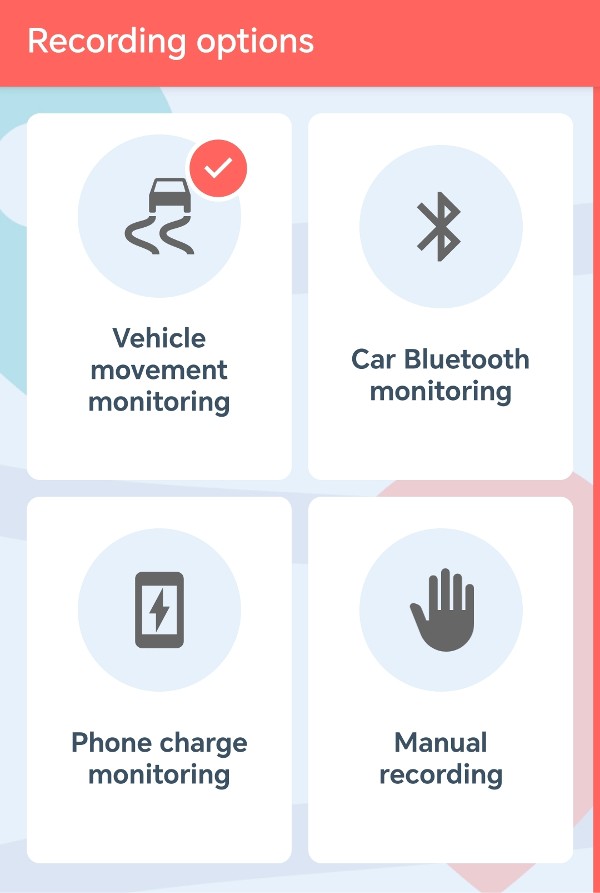

4. Automated Trip Recording:

MileageWise automates the process of recording trips, which saves time and reduces the likelihood of errors. This feature is especially beneficial for busy business owners who might forget to log each trip manually.

5. Harnessing the Power of AI:

The AI Wizard in MileageWise represents a groundbreaking feature, designed to revolutionize the way small business owners and professionals track their mileage for business and tax purposes. This innovative tool harnesses the power of artificial intelligence to simplify and streamline the process of mileage logging.

With the AI Wizard, users can easily reconstruct forgotten trips and fill in gaps in their logs, ensuring a complete and IRS-compliant record. The AI Wizard’s intuitive interface makes it user-friendly, allowing even those with minimal technical expertise to navigate and utilize its features effectively.

By automating and optimizing the mileage tracking process, the AI Wizard not only saves time but also helps in maximizing tax deductions, making it an invaluable asset for anyone looking to efficiently manage their business mileage.

6. Cloud-Based Access:

Being a cloud-based solution, MileageWise allows for the storage and access of mileage data from anywhere, offering flexibility and convenience to business owners who are often on the move.

7. Vehicle Expense Tracking:

Apart from tracking mileage, MileageWise also offers the capability to track vehicle expenses. This dual functionality makes it a comprehensive tool for managing business finances.

Maximizing Business Efficiency

Selecting the best business mileage tracker app involves assessing your specific needs, budget, and the level of detail required for tracking. Embrace technology to streamline your processes, ensure tax compliance, and ultimately drive your business towards greater efficiency and profitability.

FAQs

Do small business owners and LLC businesses get tax refunds?

Yes, small business owners and those operating as LLCs (Limited Liability Companies)alike can receive tax refunds. A refund occurs if the taxes paid during the year exceed the actual tax liability. This can be due to overestimated quarterly payments, excess withholding, or claiming more deductions and credits than the tax owed. Properly tracking expenses like business mileage can help ensure that businesses only pay what is necessary and possibly receive a refund.

How do I track a mile?

To track a mile for business purposes, using a dedicated mileage tracking app like MileageWise is highly recommended. These apps automate the process, ensuring accuracy and compliance with IRS requirements. They typically feature GPS tracking to record each mile driven for business, allowing you to maintain a detailed and IRS-compliant log. Simply start the app when you begin your trip and end it when you arrive at your destination, and the app will log each mile accordingly. This removes the need for manual entry and helps in accurately calculating potential tax deductions.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |