Last updated on December 14, 2023

MileageWise Inc. offers quite a unique approach to Mileage logging especially when it comes to Past Mileage Recovery.

Whether you are facing an unexpected IRS Audit or just want to claim Past Mileage on your taxes (as you can claim Mileage for 3 years retrospectively) Retrospective Mileage Recovery is a game changer. Especially in these COVID-ridden times.

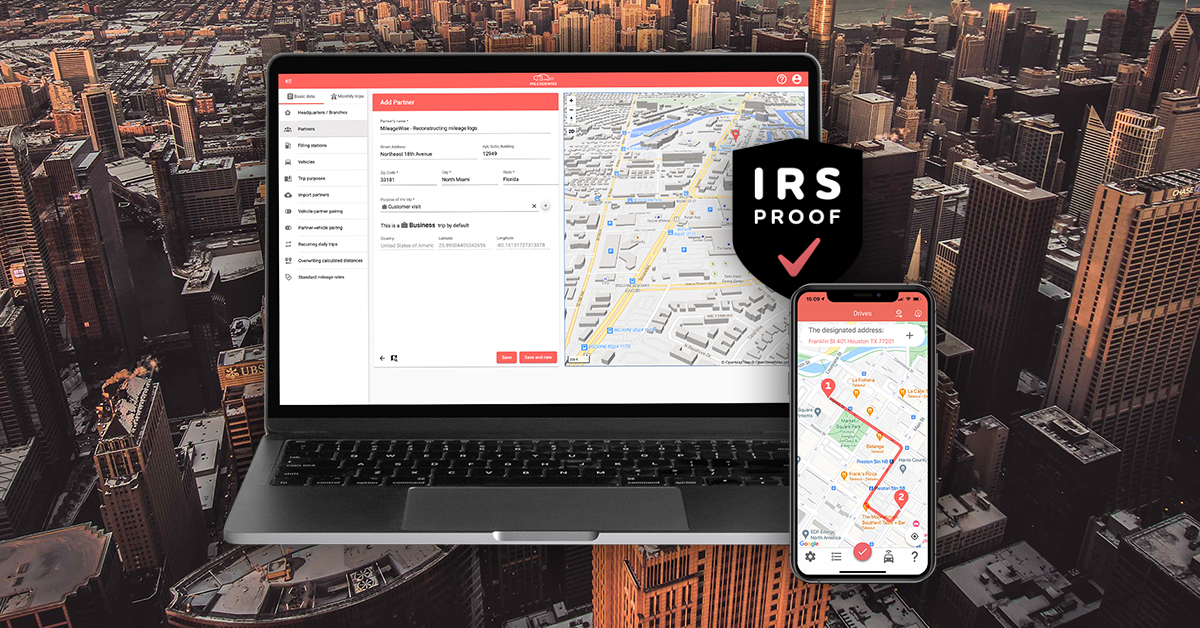

MileageWise provides a comprehensive solution for Real-time Mileage Tracking (with Monitoring-free Tracking Options) resulting in IRS-Proof Mileage logs. At the same time, they focus on making Recovering and Reconstructing Past, Lost, and Possible Mileage attainable without the help of an Accountant or any other Big Investment.

MileageWise has a two-platform formula to cover a full service for its users.

Mileage Tracker for Ongoing Tracking

The Mileage Tracker App is for recording Daily Mileage On the Go.

1. Tracking options

The Tracker is equipped with automatic tracking options that were designed without continuous GPS tracking for Battery and Data Saving and also for Privacy Protection.

2. Odometer reading and past trip recording

Save odometer readings and previous trips either by adding them in the App or on the Web Dashboard and MileageWise will calculate the distance and deduction/reimbursement amount for the User.

3. Auto-classification and work hours function

Classify your Mileage as Business and Personal (including Medical, Moving, and Charity), and by setting the working hours you can control when your trips are being recorded: During your set hours the app will automatically record your trips. Outside of the set hours, you have the freedom to not record your trips, or record them manually in case an occasional Business trip happens outside of your usual working hours.

4. Support for multi-car use

You can easily track trips with the Mileage Tracker app and create separate reports for different vehicles from your MileageWise account.

5. MileageWise for Teams

Share your Mileage Log Web Dashboard with your Accountant and Coworkers. Your Team can easily track their Mileage On the Go and they can also easily finalize their Mileage logs at the end of the month. You can also leave the summarization and finalization to the Office Manager or Accountant! Printing out the monthly Mileage logs without having to beg for the information has never been easier.

Web Dashboard for IRS-Compliance and Deduction Optimization

1. Built-In IRS Auditor on Your Side

The so-called AI Wizard feature recommends Lost or Possible (but missing) Mileage and the software checks and corrects 70 logical conflicts in the process to ensure that the Mileage logs are IRS-Proof. This AI-based technology stores and applies period-compliant legislation and Mileage Rates while taking into account the user’s vehicle usage preferences. This component ensures that the end product will meet Every Expectation.

2. Trip List Import

With this function, an Excel spreadsheet from Calendar entries or other Mileage trackers such as MileIQ, Triplog, MileCatcher (and other) reports can be imported into the Web Dashboard to perfect them for an IRS-Proof result.

3. Bulk Address import from any of your Device

Import your Addresses on the Web Dashboard and they will immediately appear in your Mileage Tracker App as well!

4. Past Mileage Recovery with the AI Wizard feature

Mileage log Reconstruction is a game-changer on the market, as to this day the task of Reconstructing Past Mileage is a complicated obligation often needing multiple sources, software packages, and occasionally the help of Tax professionals.

Many still try to reconstruct their logs on their own or with simple tools. For example, they try to recover their miles on Paper or in an Excel spreadsheet. Usually, those who tried these solutions, soon discover that the task is more difficult than it first seems. Handing in Mileage logs with Contradictions can result in a hefty fine from the IRS.

With MileageWise’s unique AI-based AI Wizard technology you can get a Recommendation for your Past, Lost, and Possible trips. Just set a few Parameters and MileageWise will fill in the Gaps of your IRS-Proof Mileage logs quickly!

5. Deduction/Reimbursement Maximization

MileageWise strongly states that the success of a product lies in “concentrating on providing a solution for one highly demanded problem, instead of trying to cram as many features into a product as possible.” The software can be particularly useful if the users’ goal is claiming the Maximum amount of Deduction/Reimbursement possible by recovering their lost miles after their Business Mileage, with Mileage logs meeting the requirements of the IRS, even retrospectively. The IRS-proof Guarantee can come in handy in case of unexpected IRS Audits as well.

It’s for you if…

MileageWise can be a useful tool for Small Business Owners, Employers and Employees, Self-Employed, Realtors, Rideshare Drivers, and Tax professionals. Several $1,000s in Tax Deductions per tax year can be claimed when supported with sufficient Mileage logs.

And if there’s too much to do in too little time, busy professionals can take advantage of MileageWise’s additional Mileage Log Tax Preparation Service, where a MileageWise Expert will prepare an IRS-proof Mileage log draft for them. It’s the same as handing over managing your Mileage logs to your Accountant.