Last updated on March 6, 2024

Have you ever wondered where your paycheck disappears each month? Or why saving seems like a distant dream? Enter the world of expense trackers – your new financial sidekick! These nifty tools are more than just digital accountants; they are the stepping stones to mastering your money management. Let’s dive in and discover how they turn financial chaos into harmony.

What is an Expense Tracker?

At its core, an expense tracker is a tool designed to help you monitor and categorize your spending to save money and keep records for taxes. Think of it as a personal finance assistant that keeps tabs on every dollar you spend, earn, or save. Whether it’s that morning latte, monthly rent, or a spontaneous shopping spree, an expense tracker captures it all.

Managing expenses with Spreadsheets

Perhaps the most popular tools for tracking expenses and income are spreadsheets. They are easily accessible and printable and there are many variations from which users can pick one that fits their needs the most. For example:

- Monthly Expense templates: For personal and self-employed use, tracking daily spending across various categories over a month.

- Income and Expenses Worksheet: A dual-purpose template for tracking both incoming and outgoing funds.

- Business Expense Spreadsheet: Focused on small business owners, including categories specific to business operations.

Depending on the worksheet template, individuals aiming to save money and small businesses preparing for their taxes alike can track and categorize their incomes and expenses and easily look through them. Excel spreadsheets are especially popular for this exact reason.

The process is straightforward but has downsides compared to other digital solutions. As our financial lives become increasingly complex and we have less and less time, the limitations of traditional spreadsheets become apparent. While spreadsheet templates excel in simplicity and flexibility, they require manual input and constant updating. Have you ever lost track of the rows of a Google Sheets worksheet? Or have you ever had to brush up on your Excel skills to have the right settings and to make reports? If these sound familiar, you might consider using a software-based income and expense tracker instead of a monthly worksheet.

Expense Tracker Software

Expense tracking software make financial management almost effortless by automating many of the tasks that spreadsheets can only accomplish manually. This transition from a static method of tracking expenses to a dynamic, automated system offers several compelling advantages:

- Spending categorization: Automatically sorts your expenses into categories like groceries, entertainment, utilities, and more.

- Budget setting: Helps you create and stick to a budget based on your income and spending patterns.

- Expense logging: Records every transaction to give you a comprehensive view of your finances.

- Reporting: Generates reports to help you analyze your spending habits over time.

Tracking expenses for business

Choosing the best app to track your business expenses depends on your specific needs, from managing monthly spending to detailed tracking of business expenses for tax purposes. By leveraging the right technology, you can simplify financial management, ensure accuracy, and save time, allowing you to focus on growing your business.

Key Features to Look For:

- Cross-platform access for managing finances on the go.

- Integration capabilities with accounting software and banking institutions.

- Real-time reporting and analytics to make informed financial decisions.

- Security measures to protect sensitive financial data.

Frequently Asked Questions

- Do I need to be tech-savvy to use an expense tracker? Absolutely not! Modern expense trackers are designed with user-friendliness in mind. They come with intuitive interfaces that make navigation a breeze, even for tech newbies.

- How safe is my financial information with these trackers? Safety is paramount. The best expense manager apps and software use bank-level encryption to protect your data. However, always do your research and choose an app with robust security features.

- Can expense trackers help me save money? Definitely! By providing clear insights into your spending patterns, these tools can help you identify unnecessary expenses and redirect that money into savings.

- Are these features available in free expense trackers? While many free trackers offer basic functionalities, premium features like automatic import and detailed analytics might require a paid subscription. However, many apps offer trial periods, so you can test before committing.

- Is it complicated to set up budgets and categories in these apps? Not at all! Most expense trackers are designed with user experience in mind. Setting up budgets and categories is usually straightforward, with intuitive interfaces guiding you through the process.

- Can I access my expense tracker on multiple devices? Absolutely! Many modern expense trackers offer cross-platform compatibility, allowing you to access your financial data on your phone, tablet, or computer.

The Secret to Picking the Right Trackers

The key lies in understanding your personal financial needs and habits. Are you a visual person? Look for an app with comprehensive charts and graphs. Do you travel often? An expense tracker with multi-currency support would be ideal. Remember, the best expense tracker is the one that resonates with your lifestyle and financial goals.

With these features in mind, you’re well-equipped to choose an expense tracker that not only meets your needs but also empowers you to take confident strides in your financial journey. Here’s to a future where managing money is not just necessary, but enjoyable and enlightening!

The Need For A Mileage Tracker App

If you drive for business, you can claim substantial deductions on your mileage, however, you need to document it properly. This is where an expense tracker can be a lifesaver. One such specialized tool that has gained popularity is MileageWise, known for its vehicle expense tracker feature. Let’s delve into how this application can make life easier for anyone needing to track mileage for business expense.

What Makes MileageWise Stand Out?

Among the plethora of expense trackers available, MileageWise stands out as a comprehensive expense tracker app focused on vehicle expenses. It’s a robust system designed to make sure every mile and every penny is accounted for.

Auto Expense Tracker – Your Financial Co-pilot

For those who spend a significant amount of time on the road, the auto expense tracker functionality of MileageWise is indispensable. This expense manager app ensures that you keep a detailed record of your vehicle expenses, from fuel to maintenance. The car expense tracker within MileageWise makes it effortless to maintain a meticulous expense record for all car-related spending.

A Monthly Expense Tracker for Every Journey

MileageWise serves as a monthly expense tracker that helps you monitor your vehicle costs consistently. It offers a clear overview, making it easier to plan and budget for upcoming expenses. As a finance tracker, it also helps you forecast future costs based on historical data, a feature that is incredibly useful for businesses and individuals alike.

Business Expense Tracker – The Road to Tax Deductions

The most significant benefit of using MileageWise’s mileage tracker is its ability to help users claim mileage deductions accurately. The app can seamlessly generate IRS-Proof mileage logs, a must-have feature for any money tracker aimed at professionals.

And there’s more. Besides offering you seamless mileage tracking for ongoing business trips, MileageWise can also assist you in retrospective mileage deduction for up to 3 years. If you just got started, but would like to cover the entire year, or even previous years, you can rely on the Google Timeline Import and the AI Wizard features.

The Best Car Expense Tracking App for Accuracy and Compliance

When looking for the best car expense tracking app, compliance and accuracy are key. MileageWise not only helps you keep a comprehensive car expense log book but also ensures that every entry is IRS-compliant. This level of detail and compliance sets it apart as potentially the best spending tracker app for vehicle expenses and mileage deduction. Take a look at a sample report generated by MileageWise.

Navigating Vehicle Expense Deductions: Actual Expense vs. Standard Mileage Method

When it comes to claiming vehicle expenses on your taxes, particularly for Schedule C filers, the IRS offers two methods: the actual expense method and the standard mileage method. Understanding these options is crucial for maximizing your deductions for automobile expenses.

Actual Expense Method: This approach allows you to deduct the actual costs of operating your vehicle for business purposes. It encompasses all operating expenses, including gas (fuel expenses), repairs, insurance, and depreciation. To utilize the actual expense method, meticulous records of all automobile expenses, as well as vehicle use dedicated to business, are essential.

Standard Mileage Method: Alternatively, the IRS permits the use of a simpler calculation – the standard mileage rate. For each business mile driven, you can deduct a set amount (travel expenses per mile). This rate covers not just fuel, but also depreciation, maintenance, and insurance. It’s vital to log how many miles you drive for business purposes to accurately write off your expenses.

Choosing the Best Method for You: The choice between the actual expense method and standard mileage method depends on several factors, including the extent of your vehicle use for business, your vehicle’s operating costs, and your record-keeping preferences. Usually, the standard mileage method grants larger deductions.

Record-Keeping and IRS Compliance: Regardless of the method chosen, maintaining accurate records is key. For the actual expense method, keep receipts and logs of all expenses. For the standard mileage method, document the dates, miles, and purposes of your business trips. Accurate documentation ensures compliance with IRS vehicle expenses guidelines and maximizes your potential deductions on Schedule C.

By understanding these methods and keeping diligent records, you can ensure you’re efficiently managing your vehicle expenses and taking full advantage of allowable tax deductions.

Business Expense Tracker – The Road to Tax Deductions

The most significant benefit of using MileageWise’s mileage tracker is its ability to help users claim mileage deductions accurately. The app can seamlessly generate IRS-Proof mileage logs, a must-have feature for any money tracker aimed at professionals.

And there’s more. Besides offering you seamless mileage tracking for ongoing business trips, MileageWise can also assist you in retrospective mileage deduction for up to 3 years. If you just got started, but would like to cover the entire year, or even previous years, you can rely on the Google Timeline Import and the AI Wizard features.

The Best Car Expense Tracking App for Accuracy and Compliance

When looking for the best car expense tracking app for business, compliance and accuracy are key. MileageWise not only helps you keep a comprehensive car expense logbook but also ensures that every entry is IRS-compliant. This level of detail and compliance sets it apart as potentially the best spending tracker app for vehicle expenses and mileage deduction. Take a look at a sample report generated by MileageWise.

Why Choose MileageWise’s Car Expenses App?

Auto Expense Tracker App: MileageWise’s dedicated features for vehicles make it more than just an expense tracker; it’s a specialized tool for your business car expenses.

Best Expense Tracker App: With features designed to ease the process of recording and calculating vehicle-related expenses, MileageWise stands out among its peers.

Money Tracking App: It’s not just about tracking what you spend; MileageWise helps you understand where your money goes and how to claim it back where possible through deductions.

Track Mileage for Business Expense: The app’s primary feature ensures that every business mile is logged, accounted for, and ready for tax time.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days.

How Does the Car Expense Tracker Work?

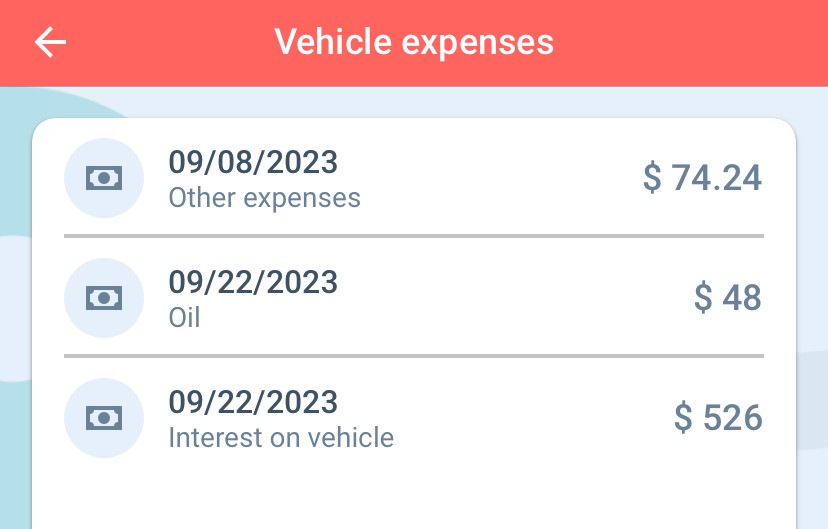

Using MileageWise’s car expenses app, users can input their vehicle’s mileage and expenses, which the app then organizes into a user-friendly expense sheet. This expense tracker not only records costs but also analyzes them, providing insights into how to optimize spending and maximize deductions. Here’s an example:

Advanced Reporting for Better Insights

The app offers advanced reporting features that allow you to analyze your expenses in depth. With custom reports, you can identify spending patterns and areas where you might be able to cut costs. The detailed reports provided by MileageWise are not only useful for tax purposes but also for personal or business financial reviews.

Automated Tracking for Ease of Use

One of the most compelling features of MileageWise is its automated tracking ability. Users can leverage the automatic trip detection feature, which ensures that all drives are captured without the need to manually start and stop a tracker. This minimizes the risk of forgetting to log a trip, which is a common issue with manual tracking.

Integration with Other Financial Tools

MileageWise can integrate with other financial tools and systems, such as FreshBooks, making it a versatile addition to your financial toolkit. This connectivity ensures that vehicle expenses are effortlessly synchronized with other financial records, providing a seamless experience and reducing the administrative burden.

Cloud-Based Accessibility and Security

With MileageWise, your data is stored securely in the cloud, giving you access to your expense logs from anywhere at any time. This cloud-based approach means that updates to the application are instantaneous and data loss due to device failure is virtually eliminated.

A Dedicated Support Team

MileageWise distinguishes itself with a dedicated customer support team. This means that users can get personalized assistance and answers to specific questions about their expense tracking needs. The team’s expertise with tax regulations can be invaluable for those who want to ensure they’re making the most of their deductions. You can, for instance, avail of our Prepaid IRS Mileage Log Audit Defense service, which offers audit protection for a small annual fee.

Continued Improvements and Updates

MileageWise is committed to continuous improvement. The app regularly receives updates based on user feedback and changes in tax laws and mileage rates. This proactive approach ensures that MileageWise remains the leading car expense tracker, always up-to-date with the latest requirements for compliance and efficiency.

Specialized Expense Tracking for Real Estate Professionals

Are you a realtor looking to make the most of mileage deduction? You need a realtor expense tracker and a mileage expense app? Well, MileageWise can definitely help you with the mileage deduction part. Let’s take a look how its mileage expense tracker works.

Streamlining Real Estate Finances with Advanced Tracking Apps

In the bustling world of real estate, agents and realtors are constantly on the move, making the need for a comprehensive real estate agent expense tracker vital for success. The ideal solution? A mileage and expense app specifically designed for the unique demands of the industry. These specialized tools serve as a robust expense and mileage tracker apps, streamlining the process of logging every journey and expenditure.

Enhancing Efficiency with Mileage and Expense Tracker Technology

With a mileage and expense tracker apps or software at their fingertips, real estate professionals can easily maintain a detailed daily business mileage and expense log, ensuring that every client meeting and property showing is accounted for. The beauty of a mileage and expense tracking app lies in its ability to simplify what was once a tedious task. No longer do agents need to manually jot down each mile in a mileage expense log; the best mileage and expense tracker apps do the heavy lifting, using advanced technology to accurately track distances traveled.

Optimizing Financial Planning with Sophisticated Tracking Tools

The best app for tracking expenses and mileage goes beyond just logging; it analyzes spending patterns, offering insights that can lead to more strategic financial planning. For realtors looking for an all-in-one solution, the best app to track mileage and expenses incorporates features like an expense mileage calculator, making it easy to estimate self-employed people’s mileage tax deductions and employee travel expense reimbursements.

Seamless Integration for Comprehensive Financial Management

What’s more, many of these apps, including some free mileage and expense tracker options, offer synchronization with other financial tools, creating a seamless financial management experience. With these apps, maintaining a mileage expense log becomes an effortless part of the day, allowing real estate professionals to focus more on their clients and less on administrative tasks.

Start Tracking Your Vehicle Expenses

For anyone serious about managing their vehicle expenses and maximizing mileage deductions, MileageWise offers an array of features that put it at the forefront of expense tracker apps. With its user-friendly interface and comprehensive money tracking app capabilities, it’s a front-runner for anyone searching for the best expense tracker app or specifically the best car expense tracking app.

Remember, an expense manager app like MileageWise doesn’t just record your expenses; it transforms them into actionable financial insights, potentially saving you money come tax time. Start with MileageWise today, and drive your way to better financial management and tax compliance.