Last updated on April 17, 2024

As our lives get more mobile, keeping track of mileage is more important than ever. Route planning and taking care of your business mileage for tax returns will help you save time, money, and stress.

In this article, I’ll talk about the many reasons why you (whether you’re an employee, a small business owner, an independent contractor, a real estate agent, or another type of self-employed individual) should track business or personal mileage in order to maximize your mileage tax deductions in the United States.

I’ll also explain the idea of a mileage tracker app and how it makes mileage logging tasks much easier and more efficient than ever before.

Are you ready to take charge of your mileage and start getting the benefits? Read on then.

What is a mileage tracker?

A mileage tracker is a tool that helps you keep track of the miles you drive for business, commuting, and other personal purposes. It can be a physical device (usually GPS-based) or a piece of software, which is most often a mileage tracker mobile application.

The way a mileage tracker works depends on the tool you use, but the basic idea is always the same. It keeps track of where you go and how far you go. Nowadays, most mileage tracking apps have automatic tracking, however, it’s a great advantage if it’s not the only recording mode a mileage app has.

Since adding details to each trip – such as the trip purpose or where it started and ended – is an IRS mileage log requirement, your mileage tracker app must allow you to collect such information, which you can use to make detailed reports that show your mileage for different time periods, your costs, etc.

Speaking of costs, some drivers use miles trackers to track expenses besides tracking mileage. This vastly depends on personal preferences, but our opinion is that you’re better off using your mobile app of the bank you have a bank account at for expense tracking.

Use your mileage tracker app for tracking mileage and let your designated bank’s app do the banking.

Benefits of using a mileage tracker

For the sake of simplicity, let’s see a list of benefits that mile trackers have:

- Accurate mileage tracking: A mileage tracker lets you keep accurate records of the personal and business miles you drive, which is important for taxes, reports of work related car expenses, and other financial records.

- Saves you time: Instead of keeping track of your mileage manually (on paper or in a Google spreadsheet), a mileage tracker app automatically tracks your mileage, saving you time and effort.

- Less stress: The above-mentioned, manual ways of tracking mileage for taxes can be time-consuming and stressful. A mileage tracker app can automatically take care of this task for you, so you don’t have to worry about it.

- Better organization: With a mileage tracker, you can easily organize your business trips and business expenses by date, purpose, or other categories. No need for merging or splitting your trips.

- Save money: If you keep accurate records of your mileage, you may be able to claim deductions on your taxes or expense reports, which could save you money.

- Better information: A mileage tracker can give you useful information about your driving habits, such as how long you spend driving, how far you go, and how much money you spend. If you happen to forget to keep a mileage log, something happens to it, or you’re just missing some miles in your mileage log, services like MileageWise’s A.I. Wizard learns these habits and gives you recommendations to fill in the gaps in your mileage reports.

- Increased productivity: If you have auto-tracking, you can focus on more important tasks, such as creating revenue. 🙂

Types of mileage trackers

There are many different kinds of mileage trackers, and each one has its own features and benefits, pros, and cons. We’ve collected the most essential perspectives of each option.

Manual mileage tracking methods

These are either paper or digital mileage log books (or logbook apps, depending on the logbook method) where you write down the date, start and end locations, and distance traveled for each trip. They are low-tech, require manual input (which takes time) and there’s no way to find out if your manual mileage log will stand up in the case of an IRS mileage audit.

Pros:

- Low-cost or free

- Simple to use and understand

- No need for internet connectivity

Cons:

- Requires manual input, which is time-consuming

- More prone to errors and mistakes

- Difficult to generate detailed reports

GPS Mileage Trackers

These use GPS technology to keep track of where your car goes and figure out how far it has gone. They can be more accurate and can make it easier to keep track of your mileage. Some GPS mileage trackers may also have features like categorizing and reporting on trips.

Pros:

- Automated and accurate

- Can track trips automatically

- Good fit for fleet companies

Cons:

- Poor privacy

- Require a constant connection to GPS and may drain your device’s battery

- May be less reliable in areas with poor GPS signal or coverage

App-Based Mileage Trackers

These are software programs that run on your smartphone or tablet. They use GPS technology to keep track of where you go and can automatically record your trips, figure out how far you drove, and optimize your usage for tax write-offs. Many mileage trackers that you can use with an app can also make detailed reports that you can export to use for taxes or expense reports.

Pros:

- Much more accurate than paper mileage logs

- Can automate the process of tracking and categorizing trips

- May offer additional features, depending on the app

Cons:

- Usually requires a subscription (there’s no free mileage tracker app that gives unlimited access)

- May drain your device’s battery if GPS tracking is constantly active (MileageWise doesn’t use GPS along the way, it connects the points of arrival for an accurate & battery-friendly result)

- May be less reliable if you switch devices or lose your data due to device failure or malfunction (it’s recommended to start a mileage log backup by Google right now)

Read more about MileageWise’s Google Maps Timeline trip import:

Mileage trackers that are built into your car

These mileage trackers are physical devices that most commonly use GPS to keep track of where you drive. They can be quite accurate, but they need to be set up by a professional and may cost a lot of money.

Pros:

- Can be more accurate than other options

- Can offer real-time tracking and alerts

- Can be more tamper-proof than other options

Cons:

- More expensive than other options

- Makes creating a mileage log harder (you need to transfer your data)

- May be less flexible if you switch vehicles or need to track miles for multiple vehicles

Features to look for in a mileage tracker

When picking a mileage tracker, there are a few things to think about that will help you get the most out of the experience.

Here are a few things you should look for as one of the many busy small business owners:

Several tracking possibilities

Automatic trip recording lets you track your mileage from the background, so you don’t have to enter data manually. This can save you time and effort and make it less likely that you’ll make a mistake.

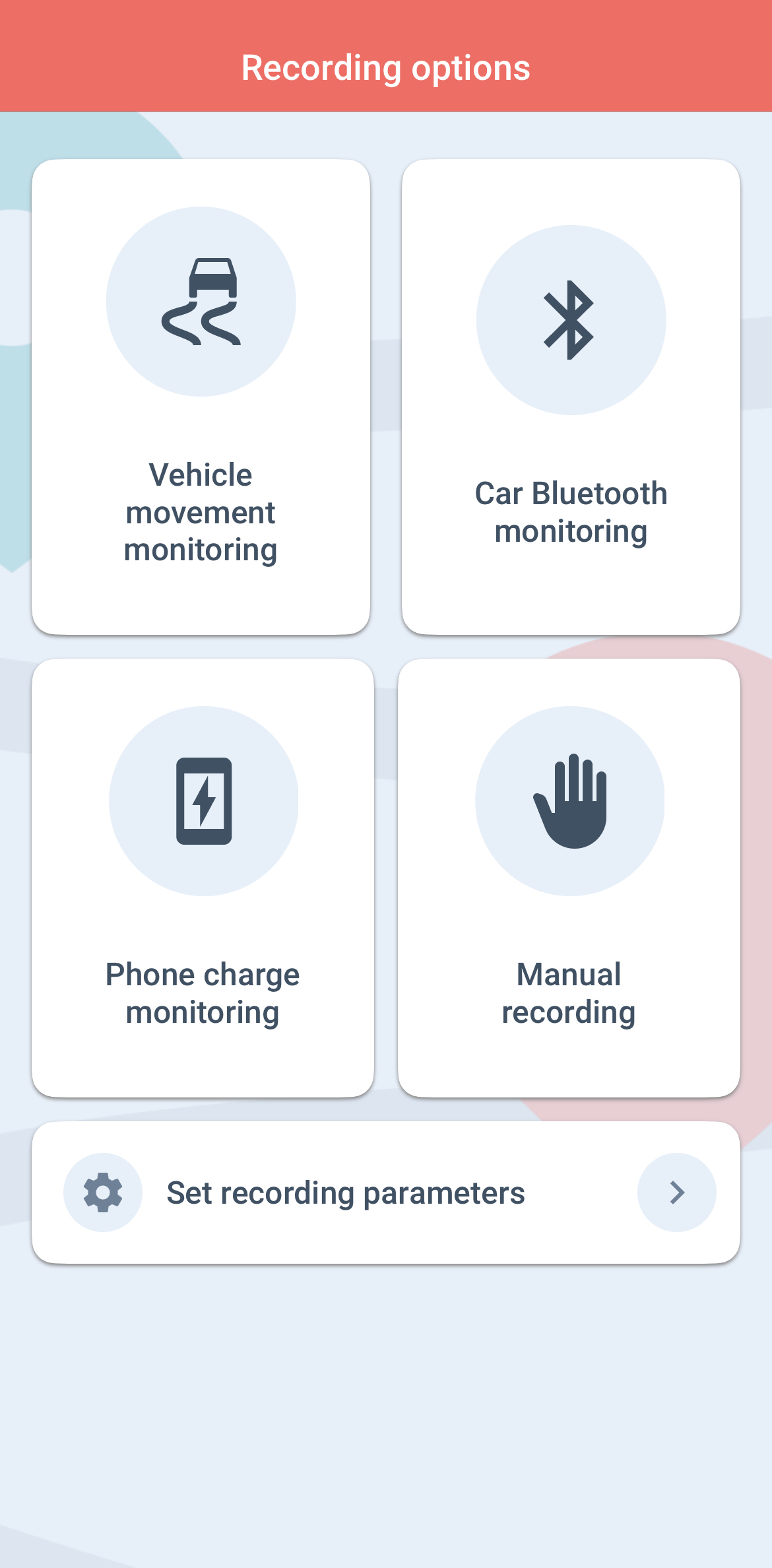

However, it’s also important to have other options in case of a malfunction. MileageWise’s mileage tracker app has 3+1 automatic trip recording modes.

Cloud Backup

This feature backs up your mileage data automatically to the cloud, so your data is always safe. It can also let you get your information from more than one device.

Reporting

This feature lets you make reports that you can use for taxes, expense reports, and other financial documents. It can also give you useful information about how you drive, how much you spend, and other things.

Automatic trip classification

This feature automatically classifies your trips as either personal or business trips. You may edit these settings in the MileageWise editing & reporting dashboard anytime.

Integration with other apps

This feature lets you connect your mileage tracker to other apps, like accounting software or apps that help you get paid for your mileage. It can make it easier to keep track of your money and streamline the way you do things.

Think about what features are most important to you and look for an app with those features. By choosing a mileage tracker with the right features, you can make it easier to keep track of your mileage, stay organized, and save time and money at the same time.

How to use a mileage tracker app

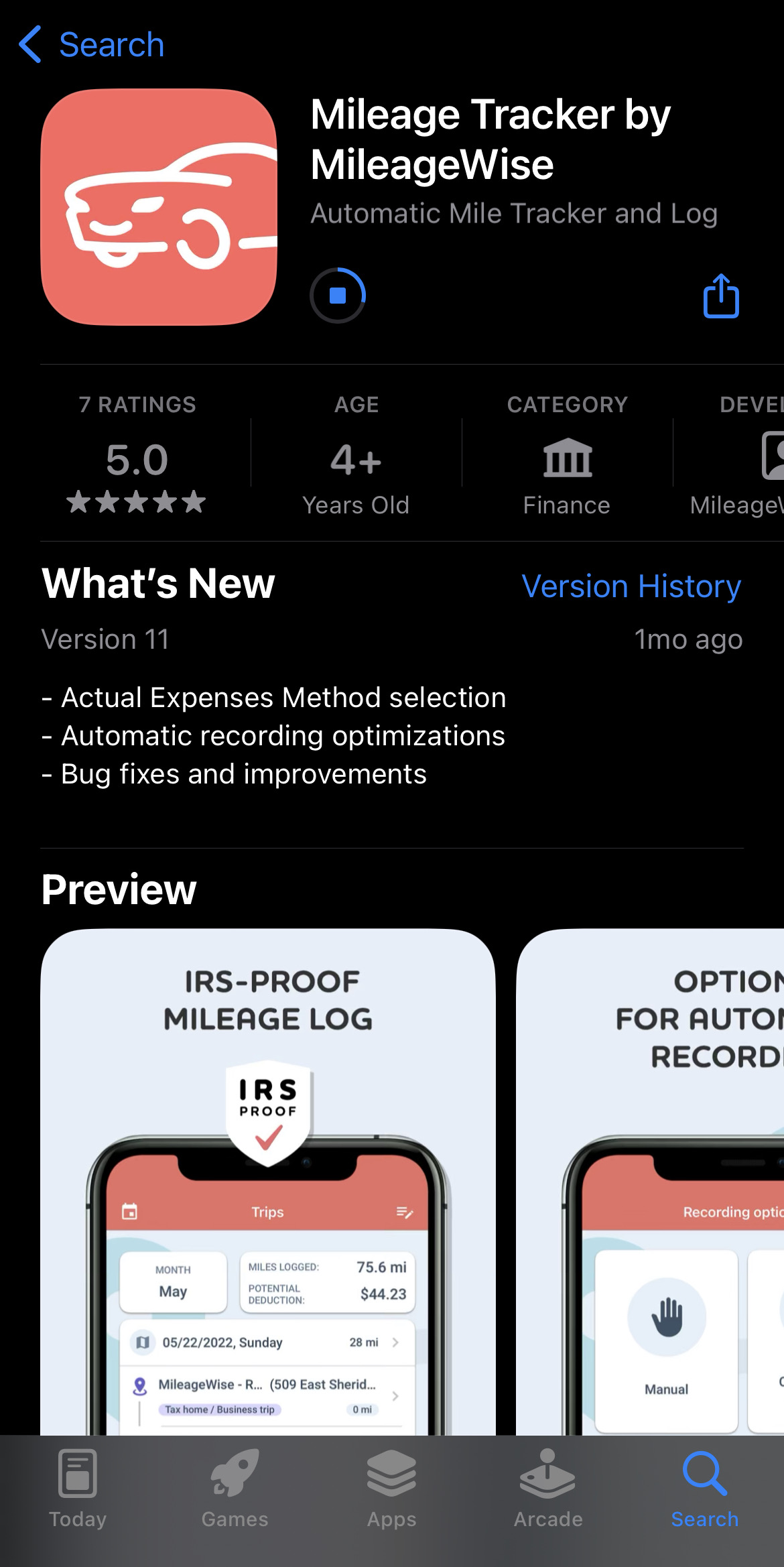

Here are the steps you need to take in order to set up and start your MileageWise mobile application (currently, this is what iPhone users see

- Download the app and install it: Find MileageWise’s mileage tracker app on App Store or Google Play, download & install it.

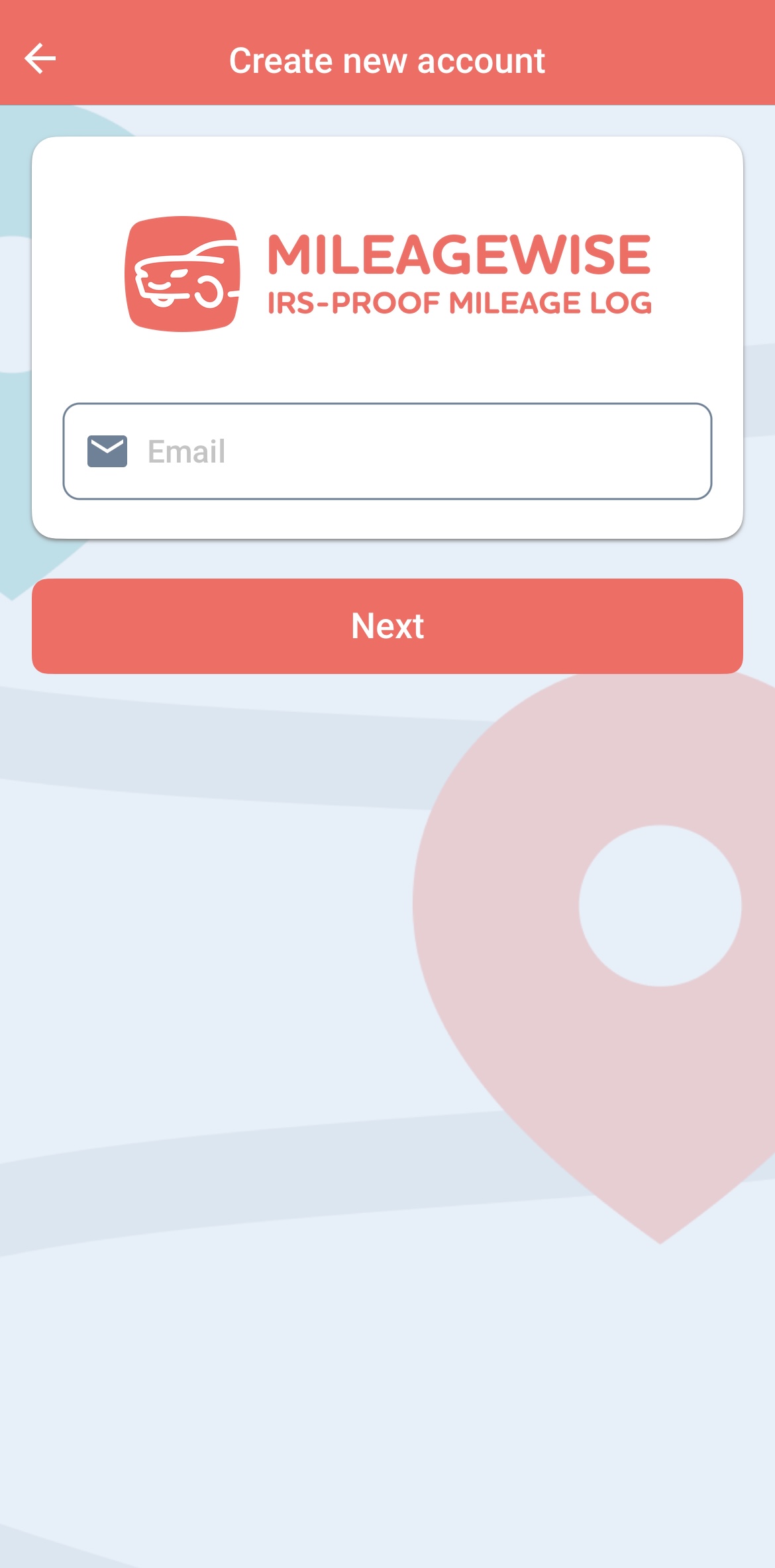

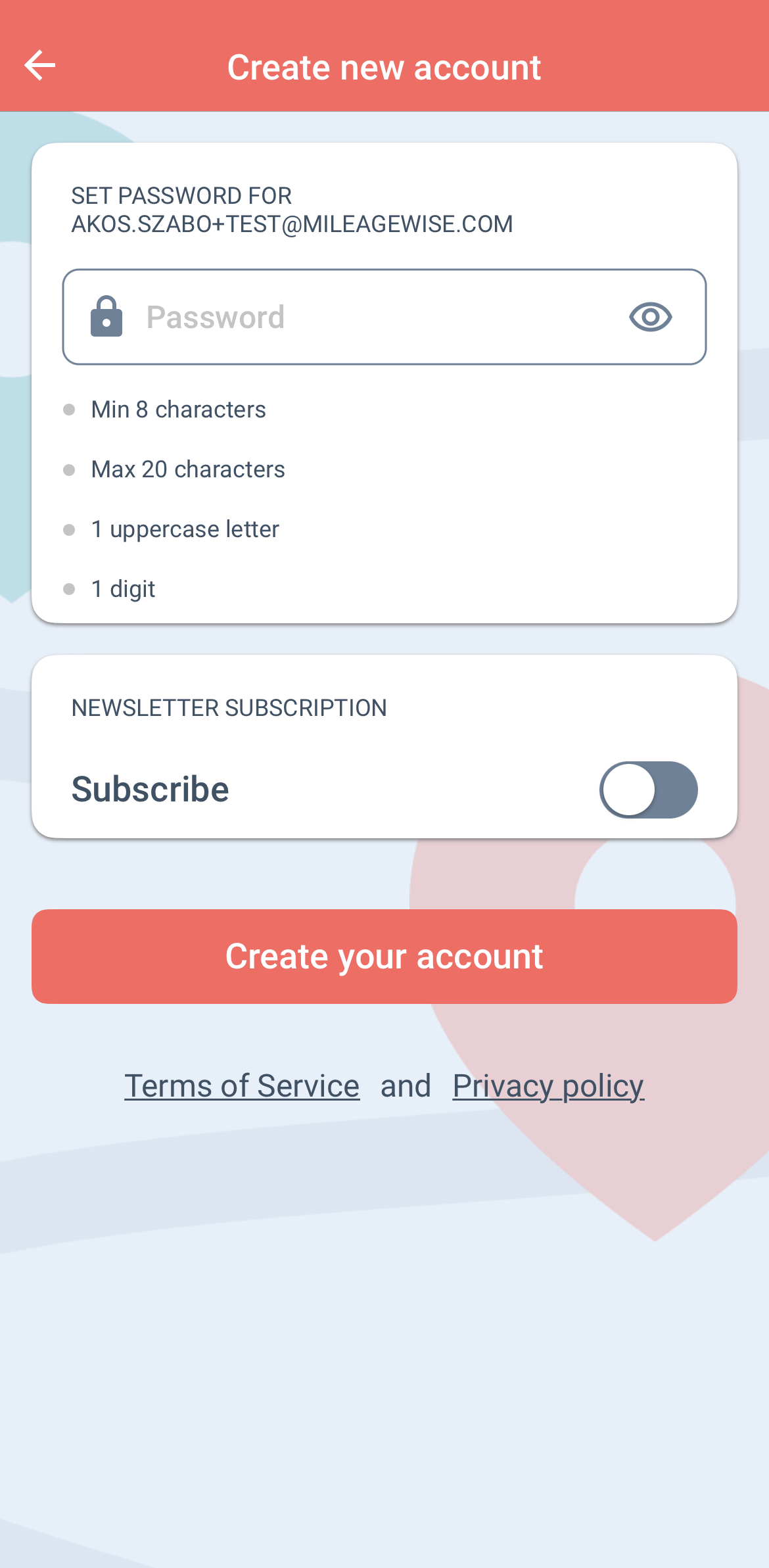

2. Create an account: Open the app and create an account by entering your name & email address. You’ll receive an email and then you can start setting up your profile

|  |

3. Choose a recording option: Depending on the recording mode you choose, you’ll be able to record your trips and keep track of the start and end times, distance, and other important information. These pieces of information will be automatically added, you don’t need to worry about anything other than opening and closing the app at the end of the day.

4. Start tracking 🙂

5. Finalize your trips at the end of each month: When finishing a month, make sure to record your end-of-month odometer reading (for the sake of easy calculation) and close your month in the MileageWise dashboard.

Tips for maximizing the benefits of a mileage tracker

- Use a mileage-tracking app: There are a number of apps like MileageWise that are made just for keeping track of mileage. With these apps, it’s really easy to keep track of your trips, plus, they automatically set the deductible amount to the IRS mileage rates for the time periods you’re creating mileage logs for.

- Set up your app correctly: Make sure your app is set up correctly by entering accurate information like the make and model of your car, find the most optimal recording option for your needs, and upload fixed trips (even from Google Maps) or client locations

- Be thorough: Make sure you keep track of all of your business trips, even if it’s just a short drive to get office supplies. This will help you make sure you don’t miss any tax breaks and max out your business plan.

- Use your mileage tracker app for every trip: Be sure to open the app before entering your car in the morning and close the app at the end of the day. If you make a habit out of this, you’ll never have issues with your mileage log.

- Review and analyze your data: Make sure you regularly review and analyze your mileage data to look for patterns or trends. This can help you figure out where you can save money or work more efficiently.

Mileage tracker apps like MileageWise help people keep track of their mileage for tax and reimbursement purposes while allowing users to set customer reimbursement rates for employees.

By using an automatic mileage app, users can save time and money because they don’t have to keep track of their miles manually and the chance of making mistakes is drastically lower compared to other options.

Why choose MileageWise as your dedicated miles tracker app?

MileageWise’s 3+1 automatic monitoring modes, trip purpose auto-classification, and Concierge service make it a splendid tool for keeping track of your mileage. With this service, they may start over or even fix your mileage records.

On top of the above-mentioned, A.I. Wizard feature, the built-in IRS auditor checks your mileage log for 70 different logical problems and fixes them, making it 100% IRS-Proof. This feature keeps you from printing your mileage log before you’ve made the necessary changes.

If you’ve got any questions, contact our support team at our customer service hotline.

Download MileageWise’s automatic mileage tracker app from Google Play or the App Store & try it for free for 14 days. No credit card required!

Check out the video on MileageWise’s mileage app:

See Why The Wise Choose MileageWise

| MileageWise | TripLog | MileIQ | Everlance | Driversnote | SherpaShare | Hurdlr | Excel | |

User Ratings (Trustpilot) | N/A | N/A | N/A | |||||

iOS App User Ratings | ||||||||

Android App User Ratings |

| |||||||

Average Possible Business Mileage Deduction | $12,000 | $6,300 | $8,400 | $6,500 | $6,000 | $5,600 | $5,600 | $200-$2,000 |

Imports Trips and locations from Google Timeline | ||||||||

Produces IRS-Proof Mileage Logs | ||||||||

Creates Retrospective Mileage Logs | ||||||||

AI Wizard Technology for Mileage Recovery | ||||||||

| Sampling / Recurring Daily Trips | ||||||||

| Mass Distance Calculation | ||||||||

| Built-In IRS Auditor for 70 Logical Conflicts Correction | ||||||||

| Web Dashboard | ||||||||

| Mileage Tracker App | ||||||||

| Vehicle Expense Tracker | ||||||||

| Manual Trip Recording | ||||||||

| Bluetooth Auto Tracking - with no hardware needed | ||||||||

| Plug'N'Go Auto Tracking | ||||||||

| Vehicle Movement Monitoring | ||||||||

| Battery and Data Friendly | ||||||||

| Other Software Integrations | ||||||||

| Trip List Import from other Mileage Trackers | ||||||||

| Trip List Import from GPS | ||||||||

| Shared Dashboard for Teams | ||||||||

Features are all related to mileage tracking | ||||||||

Pricing | Price list | Price list | Price list | Price list | Price list | Price list | Price list | Price list |