May 19, 2020

The goal of our new Case Study series is to educate our users about some common tax-related topics. We wanted to start with the not-so-fortunate cases. So that we can move on to the good practices later to show how much easier it is to claim a tax deduction by keeping and/or retrospectively reconstructing a mileage log with IRS-Proof mileage log software.

In the first Case Study, we’ve examined what happens when you claim deductions but don’t have mileage logs to support them.

But what happens if you try to reconstruct your mileage logs, but fail to recall the exact data?

Case Study #2: Sketchy mileage logs

This case is about a representative of a betting company. In said company, the employees have an annual salary of approx. $180,000 and many benefits, such as state pensions, 47 days per year of paid time off, including vacation, holidays, personal time, and sick time, and access to gold-plated health, dental, and vision insurance.

And a vehicle allowance.

Six company representatives were required to report personal mileage and repay the company on a month-to-month basis, in exchange for the paid company car and business mileage. The company charged representatives substantially less than the IRS rate for the utilization of its vehicles for individual use. The company charged 11 cents for each mile for individual use in 2016. That then increased to 12 cents and now it stands at 15 cents. The current IRS rate for vehicle use is set at 57.5 cents for every mile.

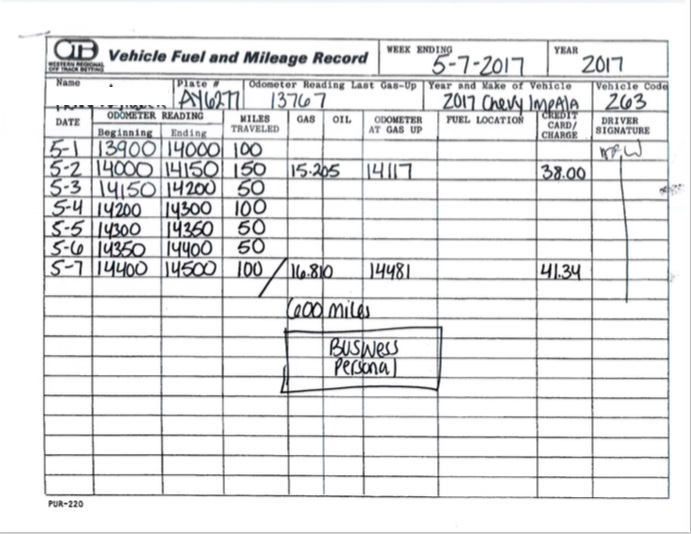

Still, there were rumors that one of the representatives, the one who is the protagonist of our article, neglected to follow the approach that requires employees “to diligently record and maintain accurate records of all personal use miles.” Most of the week-after-week mileage reports he documented lacked odometer readings or included consistently adjusted (rounded-off) numbers.

He likewise damaged the company’s approach by neglecting to repay the time for the personal use of the vehicle. He made no repayment for 17 months, from November 2017 until the time he turned in the vehicle, in April 2019, when he composed a check for $3,484.09.

The representative in question put 91,780 miles in his vehicle between October 2016 and April 2019. While he was required to report personal mileage, in excess of 33% of that mileage — 28,266 — was “unallocated”.

This was all revealed during a general state inspection. Now several government organizations inspect the company and its employees at the same time as the result of this. The authorities said, that in a company where employees fail to comply with the regulations on an individual level, other financial wrongdoings are likely to arise on an organizational level as well.

The company and its employees are about to face some serious penalties in the near future.

Moral of the story?

Those who try to record their mileage in Excel or on paper will spend a great deal of their time putting the data together and still face a penalty from the IRS as there are 70 logical conflicts you have to pay attention to when recording your mileage log. The Built-In IRS Auditor of MileageWise monitors these conflicts to make sure that all of our customers will have an IRS-Proof mileage log in just 7 minutes a month!

MileageWise retrospectively monitors the applicable laws and regulations, and our intelligent AI Wizard feature will give you a recommendation for your forgotten trips based on various parameters. We’ve made the process so easy, that you won’t procrastinate anymore when it comes to mileage logging.

But if this is not convenient enough, outsource the task of keeping your mileage log to us!